Malaysia's data centre boom faces mounting headwinds

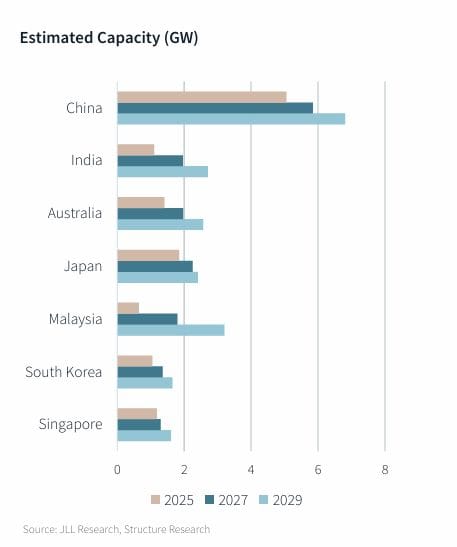

Malaysia will surpass India, Australia, and Japan in data centre capacity by 2029. But challenges loom.

The Malaysia data centre surge over the last three years has no equivalent, and I've previously argued that we are witnessing a once-in-a-generation phenomenon. However, a confluence of headwinds could yet put the brakes on its momentum.

Johor mostly taken up

For now, the growth is so strong that Malaysia is set to surpass multiple APAC countries in terms of data centre capacity within the next few years. According to JLL's report released in August, Malaysia leads in upcoming data centre capacity across the region with 3,530MW of capacity, of which 2,570MW is in Johor.

From being the last amongst top APAC markets today, by 2029, Malaysia will have more data centre capacity than either India, Australia, Japan, South Korea, or Singapore (see chart below). This is astounding.

Separately, it seems the Johor data centre market is almost fully taken up in the first half of 2025 with a vacancy rate of just 1.1 per cent, according to a new Knight Frank report.

Headwinds coming

It's worth noting that the incredible growth of data centres has changed the ground reality in various ways. The first challenge is resource constraints. Certain parts of Johor will no longer supply data centres with fresh water, as demand exceeds supply. While this is generally a temporary situation until more water treatment plants are built, it underscores how rapid data centre growth has skewed demand projections.

The same issue is happening with power demand, which is putting significant strain on Johor's power infrastructure. Sedenak Tech Park, for instance, has no available power capacity right now, according to DC Byte's Vivian Wong.

The second challenge is rising prices. Costs for building and operating data centres have increased significantly from three years ago. This can be attributed to electricity tariffs that rose in July, water tariffs that increased in August, service tax, land and construction costs, and a potential fuel surcharge.

Will these multiple forces serve to dampen or even break the current momentum for data centres in Malaysia? Someone I spoke to noted that "Malaysia is still cheaper than Singapore" which is true enough. But would it open the door for countries like Thailand and Batam to potentially steal a march on Malaysia?